Your

FAQs

Who can pay the Marchamo and where can I pay it?

How do I request a technical vehicle inspection appointment?

What information do I need to provide to obtain my inspection or re-inspection appointment?

– License plate number / DUA (for registration vehicles)

– Type of vehicle (light-duty, semi-trailer, motorcycle etc.)

– DEKRA station of your choice

– Date and time

– Email address

– Telephone number

What should I bring to my inspection appointment?

The only thing you must present at the time of inspection is your driver’s license. It is important that it is valid and that it matches the type of vehicle you drive.

If you want to know more about the rules of entry to our stations you can enter the following link:

https://www.dekra.cr/es/reglamento-38516/

What items are owed yearly to my employees? (Christmas Bonus, Holidays and vacation information)

– Labor risk policy and Social security plan- (INS and CCSS)

– Copy of their Social security card in their wallet or on them at all times

– Copy of their payment slip on them or in their wallet or purse at all times

– We highly recommend a labor contract as well upon hiring an employee.

– We highly recommend that the employee open their own bank account and that employer do online deposits or deposits into their account for payments of salary, vacation and other benefits, as record of payment versus cash.

What employees should have in addition to such benefits...

CHRISTMAS BONUS (AGUINALDO):

Christmas bonus should be paid by the 2nd week of December of each year. Public institutions may pay it earlier and it is determined each year. The calculation of the amount to pay for Christmas bonus for your employee is basically adding up all the amounts earned from December 1st of the present year to November 30th of the present year. Then that amount should be divided by 12. If you pay the worker monthly, and the worker has worked an entire year, it is like paying a ’13th’ month. If not, then you add up what has been worked and divide it by 12, if the worker has worked less than a year, then it will basically be worked on to one day of pay for each month worked. Here is a link that may be helpful for you to calculate such amounts. Feel free to also request that Uvita Law Firm assist with calculations.

http://www.crtrabajos.com/herramientas/form-aguinaldo.php Always remember to document any payments like Christmas Bonus and preferably have the Money transferred to their bank account or given to them by check, as proof of payment along with a signed receipt.

VACATION:

You are obligated to give your workers paid vacation time, once they have completed 50 weeks of work each year. If the timing is bad for you, you can grant vacation time any time during the 3 months following the year mark (50 weeks) to provide the time for them to take vacation. Depending on what type of labor they perform and how they are paid, the vacation time runs from 12 to 15 days per work year. These days do not include paid holidays, since that should be given to them anyway. For example, if their vacation time includes Christmas Day, you would need to add on an additional day to substitute the Holiday day that would have been received anyway. I suggest that you consult with a legal counselor if you have any questions. It is important that the vacation actually be taken-therefore they should not come to work- and they should be paid as normal days. You cannot pay them their vacation and have them come to work, which was done in the past. They should also be consecutive vacation days. The idea is that everyone needs a good 2-week rest each year to avoid stress in general. Always document such payments by having them sign when receiving the vacation pay and vacation days.

HOLIDAYS:

Some holidays are optional, some are not. Here is the list of Holidays that require double pay in Costa Rica. This means, that if they come to work on these days, they would be paid double what they would make in a normal day. If they do not come to work, they will still receive normal pay, but not double.

HOLIDAY, DATE

New Year’s Day, January 1st

Easter Sunday, March 31st

Juan Santamaría’s Day, April 11th

Labor Day, May 1st

Acquisition of Guanacaste Day, July 25th

Virgin of Los Angeles, August 2nd

Assumption & Mothers’ Day, August 15th

Costa Rica Independence Day, September 15th

Día de las Culturas (similar to Thanksgiving), October 12th

Christmas Day, December 25th

LIQUIDATION/SEVERANCE:

If you are going to fire a worker, no matter how long they have worked or what they were fired for, they accumulate vacation and Christmas bonus benefits. They only have the right to severance and notice payments (plus the others) upon working 3 months or more. Christmas Bonus, for workers that have not worked the full year and are fired or quit, should be calculated as follows: 1 day of pay per month worked. Same goes for vacation pay. Severance and notice (preaviso), in cases where they have worked more than 3 months, should be calculated by your Uvita Law Firm or directly in the Ministerio de Trabajo, (Labor Department), with a translator and jointly with the employee. Any payments related to this issue should be documented and this should all be done with legal counsel.

*All items related to Employees should be documented.

Your

Friendly Reminders

Regarding Vehicles

Before December 31st to pay without penalties: Payment of your Marchamo (or right to circulate in motor vehicles in Costa Rica. This is like paying for your yearly license plate taxes in the United States). This can be paid at almost any bank. The Costa Rican banks give you the option to pay online if you have an account with them. It does vary yearly, the price of the marchamo is determined by your car’s model, manufacturing year and brand. Note: If you got tickets for driving infringements you have to pay them at this point. You can find the value on line through visiting the INS website, using this link:

http://marchamo.ins-cr.com/Marchamo/Marchamo/frmConsultaMarchamo.aspx

Anyone can pay for the marchamo by simply providing the license plate number, it doesn’t have to be the owner of the car. To pay the marchamo your vehicle has to pass the RTV inspection (see details below). After paying for the marchamo at a local bank they will give you a new official circulation card. You cannot loose this card, you have to have it in your car at all times. This card comes with a sticker that is required to post on the corner of your windshield. The sticker may distort or lose color from the sun, it is for this reason that you have to have the circulation card in your glove box.

DEKRA INFORMATION:

This test is equivalent to the emissions testing in North America. You are required to do this each year for your vehicle; for older cars and for almost brand new cars every two years. You have to make an appointment to have your vehicle tested. Go to the following website to make the appointment: www.dekra.cr or

When you take your vehicle for inspection is as follows:

License plate ending in 1: January

License plate ending in 2: February

License plate ending in 3: March

License plate ending in 4: April

Plate finished in 5: May

Plate finished in 6: June

Plate finished in 7: July

Plate finished in 8: August

Plate ending in 9: September

License plate ending in 0: October

Required documentation:

– Valid driver’s license that matches the type of vehicle you drive.

The inspection checks on your car’s CO2 levels, lights, breaks, shocks, tires and so. Your car will go through various tests. It is recommended to have your car inspected and fixed before going to your appointment in order to avoid failing the test or you will have to do it all over again.

Regarding Properties

PROPERTY TAX:

On December 31st, March 30th, June 30th and September 30th of each year, your property taxes are due in the local Municipality. These can be paid up to one year in advance, starting the first week of each year, or can be paid quarterly on or before the dates provided above. You can pay these taxes by having your corporate ID, your ID number (depending if the property is in your name or your corporation name) or the property number itself and going to the Municipality and pay it. Or, you can do it online through the National banking system (Banco Nacional and Banco de Costa Rica) or you can go to the bank and deposit the funds into the Municipal account. In any case, make sure you get a receipt from the Municipality or if done online or by deposit, make sure you scan the deposit and send an e-mail aquesada@munideosa.go.cr or fax +506 2786-84952 to the Municipality requesting your receipt. Keep your receipt and deposit slips in a safe place.

LUXURY TAX:

Due on or before January 15th of each year. The tax is obligatory for owners of homes whose price by January 1st, 2013 exceeds ₡117 million ($234,000). If you have questions regarding Luxury tax, please contact Jeimy or Endrina from E & T Escrow and Trust Solutions +506 2771-6789 / +506 2771-7856 / +506 2771-7849 or through the following e-mail: info@escrowandtrustsolutions.com

REGARDING A CORPORATION

EDUCATION AND CULTURE STAMP:

This is a stamp that should be paid to the tax office yearly, on or before December 31st. The Tax is based upon the amount of the capital stock of your corporation. As such your first step is to determine the capital amount with which your corporation was registered. This can be paid online through your bank account or handled by an accountant. For more information regarding this, please contact E & T Escrow and Trust Solutions, as mentioned above for the Luxury tax information.

REGARDING LABOR LAW

CHRISTMAS BONUS (AGUINALDO):

Christmas bonus should be paid by the 2nd week of December of each year. Public institutions pay earlier and it is determined each year. The calculation of the amount to pay Christmas bonus is basically adding up all the amounts earned from December 1st of the present year to November 30th. Then that amount should be divided by 12. If you pay the worker monthly, and the worker has worked an entire year, it is like paying a ’13th’ month. If not, then you add up what has been worked and divide it by 12. You can also find the out how much is it adding the salary per month using this link: http://www.crtrabajos.com/herramientas/form-aguinaldo.php

VACATION:

You are obligated to give your workers paid vacation time, once they have completed 50 weeks of work. If the timing is bad for you, you can use any time of the 3 months following the year mark to provide the time for them. Depending on what type of labor is performed and how they are paid, the vacation time runs from 12 to 15 days a year. These days cannot include paid holidays, since that should be given to them anyway. You should consult with legal counsel before deciding which amount of days they receive. They have to be taken and paid as normal days. You cannot pay them their vacation and keep them on working, which was done in the past. They should also be consecutive. The idea is that everyone needs a good 2-week rest each year.

HOLIDAYS: Some holidays are optional, some are not. Here is the list of Holidays and their current status in Costa Rica: (Kris, estos son los feriados de ley, de pago doble si es trabajado)

HOLIDAY’S DATE

New Year’s Day, January 1st

Easter Sunday, March 31st

Juan Santamaría’s Day, April 11th

Labour Day Costa Rica, May 1st

Guanacaste Day, July 25th

Virgin of Los Angeles, August 2nd

Assumption & Mothers’ Day, August 15

Costa Rica Independence Day, September 15

Día de las Culturas, October 12th

Christmas Day, December 25th

LIQUIDATION/SEVERANCE:

If you are going to fire a worker, no matter how long they have worked, they accumulate vacation and Christmas bonus benefits. They only have the right to severance and notice payments (plus the others) upon working 3 months or more. Christmas Bonus, for workers that have not worked the full year and are fired or quit, should be calculated as follows: 1 day of pay per month worked. Same goes for vacation pay. Severance and notification (preaviso), in cases where they have worked more than 3 months, should be calculated by your legal advisor or directly in the Ministerio de Trabajo, (Labor Department), with a translator and jointly with the employee.

All items related to workers should be documented.

WHAT WORKERS SHOULD HAVE IN ADDITION TO THAT:

– Labor risk policy and Social security plan.

– Copy of their Social security card in their wallet or on them at all times.

– Copy of their payment slip on them or in their wallet or purse at all times.

– I highly recommend a labor contract as well upon hiring an employee.

– I highly recommend that the employee open their own bank account and that employer do online deposits or deposits into their account for payments of salary, as record of payment versus cash.

Applying For

Residency

Should I apply for residency in Costa Rica? If so, which types and how?

See the following FAQs to see requirements and status options.

*Please note there has been no formal response from the government about the extension of valid drivers license. As of now your drivers license is only valid for 90 days. We hope the government will confirm 180 days soon.

General Requirements

There are several options if you are considering applying for residency in Costa Rica. The migratory categories and their specific requirements are described below, however, general requirements (1-9) are applicable to all of the categories.

NOTE: All documents must be “Apostilled” per the Apostille Act, certified in your country of origin (www.apostilla.com). If your country is a member of The Hague Convention on the Legalization of Foreign Documents that is all you will need to do.

If your country is not a member of that treaty, then you will have to send it to the Costa Rican consulate for your jurisdiction for authentication.

Click here to see if your country is on the list:

https://www.gsccca.org/notary-and-apostilles/apostilles/hague-apostille-country-list

General Requirements

1. Application: An application addressed to the Director General of Migration by the person applying. If the applicant is not going to be able to go in person, he/she should grant a special power of attorney to a representative in Costa Rica, who will sign the residency application form and present all the documents in the Immigration offices. This power of attorney should be in Spanish, notarized and should follow the authentication procedures or the Apostille Act. We recommend issuing the power of attorney while you are in Costa Rica. Uvita Law Firm can help you to do this.

2. Limited Power of Attorney: The applicant should grant specific and limited power of attorney to a representative that will carry out this process for the applicant. This document could be either signed in Costa Rica in front of an attorney and Notary Public or authenticated in the Consulate or authenticated (notarized) and must be Apostilled. It should indicate the personal information of the representative who is receiving the power of attorney and the fax number where notifications should be received.

3. Birth Certificate: You must provide a NEW certified copy of your birth certificate and one for each of your dependents. This certificate is only valid for 6 months from the date they are issued.

4. Federal Police Certificate of Good Conduct: This certification is obtained from the Federal Police department where you last resided. You will need to check with the Police department regarding what is the best way to obtain it.  Note that this certificate is only valid for 3 months from the date it is issued.  If this document expires while you are putting together the rest of the documentation, then you will have to obtain another one. If the document expires after you have submitted it to immigration and they have not processed your application you will NOT have to submit another one. For further information please access the following link: http://foia.fbi.gov/firs552.htm.

5. Translation of Documents: Once you have compiled all your documentation, all documents that are in English must be translated into Spanish. Our Law Firm can handle this procedure (some charges may apply).

6. Proof of Registration With Your Local Embassy: Your local Embassy in Costa Rica must provide you with a letter or certificate indicating that you have registered with them. This is now a pre-requisite to the approval of immigration residency status in Costa Rica.

7. Marriage Certificate: (If the applicant is married, this certificate is needed.)

8. Photocopy of the passport certified by the Consul: This is required for the applicant, spouse and any dependent children and can be done by a Notary Public, but in this last case, the copies will also have to be certified.

9. Photographs: The application requires two (2) photographs. However, we recommend you have at least eight (8) photographs during the various stages of processing.

10. Dependents: Eligible individuals can claim their spouses and children under 18 as dependents, as well as older children with disabilities. A son or daughter between 18 and 25 can be included as dependent if he or she is enrolled in a University or College.

11. Filing for families: In the case of a family group, an individual file is required per member. Parents should sign applications on behalf of children who are minors.

12. Professional Practice: To practice a profession, the individual concerned should provide his or her diplomas. Concerning other professional activities, relevant documentation such as course and studies documentation should be submitted.

IMPORTANT All the residency statuses will require, upon approval, a guarantee deposit of US$335.00 per person, as well as the cost for the issuance of an ID card (cost today is US $150.00 per person).

For more information, please contact us via our Live Chat on the website, or to the following e-mail: Info@UvitaLawFirm.com

Retiree Residency Status

TO OBTAIN RETIREE (Pensionados) RESIDENCY STATUS

Pension amount: The applicant should receive at least one thousand dollars (US$1000.00) a month from a qualified retirement plan or a lifetime pension source outside Costa Rica.

Income certificate: The applicant should provide an original document from the company, government or institution guaranteeing that the monthly income will be sent to Costa Rica in the name of the applicant. (This can be obtained from the U.S. Embassy in Costa Rica in some cases)

Renters (Rentistas) Residency Status

RENTERS (Rentistas) RESIDENCY STATUS

Proof of Income: The applicant should demonstrate that he or she will receive income from an investment such as a certificate of deposit or annuity of at least US$2,500.00 per month for the whole family group.

Conversion to Colones: The income should be converted into Costa Rican colones. The colones exchange rate is established by the Central Bank of Costa Rica. (See exchange rate for Banco Central here: http://indicadoreseconomicos.bccr.fi.cr/indicadoreseconomicos/Cuadros/frmVerCatCuadro.aspx?CodCuadro=400

Deposit: A deposit of US$ 60,000.00 in an approved Costa Rican bank will satisfy the government requirements for the residency status.

No work policy: The Rentista (and their dependents) cannot work and/or earn a salary in Costa Rica. They can however, administer their own investments, but without a salary.

Investor Residency Status

Investment of $150,000 in stock or a money-making endeavor: To qualify for investor status the applicant will have to demonstrate an investment of at least US$150,000 in Costa Rica. According to the regulations: “The investment amount must be $150,000 United States dollars or more according to the official exchange rate which is established by the Central Bank of Costa Rica. The investment can be made in tangible property, shares, negotiable instruments, productive projects or projects which are deemed of national interest”.

Investment in Property: The regulations have loosened up a bit in this category, so that the purchase of property in Costa Rica with a value of US$150,000.00 if properly structured should qualify the purchaser and their immediate family under the investor category.

Status For Being Relatives Of A Costa Rica Citizen

STATUS FOR BEING RELATIVES OF A COSTA RICAN CITIZEN

Permanent Residency:/ Permanent residency can be applied for if you have first-degree family members such as parents, siblings, spouses and/or children who are citizens of Costa Rica. This includes children who are born to a Costa Rican citizen outside of Costa Rica and also to a baby born to foreign citizens in Costa Rican territory.

Marriage Certificate: When the applicant is married with a Costa Rican citizen, the Marriage Certificate should be issued by the Civil Registry (Registro Civil) in Costa Rica. The same applies for Birth Certificates in case of children or siblings born in Costa Rica.

Photocopy of ID: (cédula de identidad) of the Costa Rican citizen relative of the foreign applicant should be submitted as well.

Student Residency Status

STUDENT RESIDENCY STATUS

To obtain a student visa, the applicant should provide:

a)Â Enrollment in an educational private or public center, recognized by Costa Rica;

b) Relevant academic diplomas authenticated by the Consulate.

c) Proof of sufficient economic resources for the duration of the educational program.

Temporary Workers (Work Visa)

TEMPORARY WORKERS (Work visa)

The following individuals might obtain a temporary working permit in Costa Rica:

a) Scientists, professionals, teachers, technicians and specialized staff hired by companies or institutions based in Costa Rica;

b) Businessmen and board members of national and international companies.

The employing company or institution should provide a document describing the:

a) Functions to be undertaken by the employee;

b) Length of the contract;

c) Salary or wages to be received and

d) Why they need to employ that particular individual (justification of employment).

IMPORTANT All the residency statuses will require, upon approval, a guarantee deposit of US$335.00 per person, as well as the cost for the issuance of an ID card (cost today is US $150.00 per person).

For more information, please contact us via our Live Chat on the website, or to the following e-mail: Info@UvitaLawFirm.com

Costa Rica &

REAL ESTATE

Should I form a corporation to buy property in Costa Rica? If so, what type?

The recommended type is an SRL (similar to an LLC) unless you are a business with many shareholders that are not family.

Is a realtor required in Costa Rica?

What’s the average real estate commission?

This is all subject to negotiation between Seller and Agent. The sales price when higher should be given a lower commission. Feel free to ask us to review your real estate commission agreement.

What’s VAT in Costa Rica?

It’s important prior to buying or selling to know the costs you will incur, including VAT.

What’s Luxury Tax in Costa Rica?

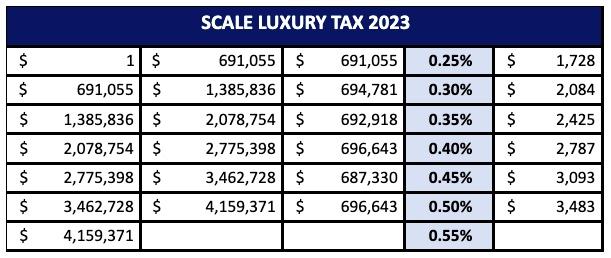

Once all the constructions in the property have a value over ¢148.000.000.00 or $275,677 App. The form D179 must be filed to pay the Luxury tax and it is due on January 15 of every year. This tax starts at 0.25% to 0.55% on the value of the constructions and portion of the land use for living.

Law number 8683 of November 19, 2008, created the Solidarity Tax for the Strengthening of Housing Programs (ISO), known as the “Tax on luxury homes”. This tax falls on the value of real estate for residential use, used on a regular, occasional, or recreational basis, including fixed and permanent installations. Every three years, those obliged to pay this tax must present a statement that updates the tax value of the real estate. If it exceeds the value recorded by the Administration, the new declared value automatically modifies the applicable tax base for the fiscal period in which it is declared.

The deadline for payment is January 15, each year.

In order to file the company must be registered for the tax so please let me know if you authorize us to work on the estimation to determine if your home qualifies for it and then you can approve the filing and payment.

Sanctions apply for non-payment of the obligation. In case of not presenting the declaration, the sanction is half the base salary, that is US$861 approximately and if it is filed late, you must pay 1% on each month or fraction of the month on the amount left to cancel.

The applicable interest rate is 12.8%.

Once the property value for the building only is over $275,677 due January of every year. This tax starts at 0.25% to 0.55% on the value of the constructions and portion of the land use for living.

Following are the rates for the year 2023, which should be applied to the total amount without excluding the exempt amount, and in a staggered manner:

How much do I expect to pay in closing costs?

This excludes, escrow fees, powers of attorney, corporation costs and due diligence costs.

For more specifics, please contact us as each transaction is specific to its needs.

Who pays closing costs?

It’s common to see it done this way or buyer pays all- but rarely does seller pay all as buyer’s lawyer should process the title transfer for their security. The fair way is 50/50 and ensures both lawyers work hard to complete the deal and Seller isn’t left paying extra fees both to closing lawyer and extra counsel.

Can I use a US escrow?

How can I cancel out my corporation once I sell?

Costa Rica &

Intellectual Property

Lisbon Agreement Regarding the Protection of the Denominations of Origin and their International Registration

This international treaty includes Costa Rica and establishes a system of international recognition of denominations of origin, registered in each of the member nations, which today surpasses 30 countries.

Copyright

The owner of a commercial name or Logo, has the exclusive right to prevent, third parties from using identical or similar signs or names for the same business, or for the same products or services or related products and services, if done so without the owner’s consent.

Industrial property

Industrial Property is one of the two branches that conform the Intellectual Property division and includes everything related to patents, trademarks, industrial designs and geographical indications and designations of origin.

In Costa Rica, the governing institution in the field of Intellectual Property, is the National Registry which is the only government entity authorized to register, protect and disclose these acts. For Industrial Property, there is a specialized registry that matriculates and protects logos, brands or names that distinguish one company, product or service.

Due to the importance of this issue in society, we want our esteemed clientele to understand the importance of registering their trademarks, logos, and business names, but in this article, we will exclusively explain trademarks.

Protection

Although trademark registration is not mandatory, it must be protected because its registration grants the owner the exclusive right to prevent others from using the same or similar trademark for the same/similar products or services and thereby avoid confusion among consumers.

Trademarks

It is any sign or combination of signs that allows a consumer to distinguish assets, products or services from one another. In other words, they are those signs that businesses and consumers use to identify and distinguish products or services on the market. Refer to: (Art. 2 Trademark Law and Other Distinctive Signs N°7978, Costa Rica)

A trademark can consist of a sign or combination thereof, as well as including words or group of words, personal names, letters, numbers, figures, monograms, portraits, labels, badges, prints, vignettes, borders, lines or stripes, combinations and arrangements of colors as well as sounds.

They also may consist of the form, presentation or conditioning of the products, its packaging or wrappings or the means or places of sale of products or corresponding services. (Article 3 of the Trademark Law and Other Distinctive Signs, N°7978, Costa Rica.)

The main function or purpose of the Trademark

It is to enable consumers to identify and distinguish a product or service as well as their business/company origin. Also, they serve as an advertising channel thereof and can be an important business asset.

Priority Right

The “priority” is the benefit that a person can obtain regarding the presentation of the first application for trademark registration by filing a subsequent application of the same trademark, in some other country. This applies to those who have correctly submitted a trademark application before the Paris Convention for the Protection of Industrial Property.

The priority right lasts for six months from the day following the presentation of the priority application and will be invoked through an express declaration that must be made with the registration application or within a period of two months.

Period

The period of validity of a trademark is for 10 years from its date of registration and the protection is National.

Renovation: This can be requested and presented within the year prior to expiration or within 6 months after the expiration date of the trademark.

Proprietor/Holder Rights

The holder of a trademark has the exclusive right to prevent, without their consent, third parties from using identical or similar trademarks for the same products or services or for similar products and services.

Solutions For

Escrow

About Escrow

E&T Escrow and Trust Solutions S.R.L. is a Costa Rican company duly registered and established in 1996 in San Isidro de El General, county Pérez Zeledón, Costa Rica, however, it was in 2002 when the company began to offer professional services in the field of Escrow, Finance and Accounting. Officially it was registered before The General Superintendency of Financial Institutions “SUGEF” through session 687-2007, Article 10 of November 26th, 2007, in which the authorization for Trust management or any type of resource management by natural or legal persons other than financial intermediaries was issued in accordance with Article 15 of Act 8204 Law on narcotics, psychotropic substances, use of unauthorized drugs, related activities, money laundering and financing of terrorism.

During 2014 and 2015, the company participated in the Evaluation that The Financial Action Task Force of Latin America “GAFILAT” performed in Costa Rica as part of the revision of the systems and mechanisms created to implement money laundering and terrorist financing prevention systems. In this process, E & T acted in representation of the supervised companies by SUGEF for activities stated in Article 15 of Act 8204.

Escrow Services

Company officially registered before the Government Financial Supervisory Agency (SUGEF) to stewardship from tiers and trusts. Our Company offers services performed by highly competent professionals specialized in Custody of funds, accounting and tax administration fields.

Escrow Fund Management

– Guarantee Trusts.

– Administration of Trusts.

– Living Trust.

– Planning and organization of corporate activities.

– Escrow and trust funds for real estate transactions in Costa Rica.

– Payment account management for land, corporate and luxury taxes, utilities, salaries, construction, social security, insurance (labor risk, home, vehicle), purchase of vehicle, others.

– Funds management for any kind of payments -(construction, repair, road maintenance, purchase, Payroll, real estate, insurance, others).

– Property management.

– Labor compensation assistance.

General Accounting

– Organization and implementation of accounting systems

– Accounting records and presentation of financial statement · Advising and tax planning.

– Financial

– Preparation of budgets.

– Cash flow.

– Financial analysis.

– Analysis and evaluation of projects.

– Accounting and financial consulting.

– Internal control

AUDITS

– Financial, Administrative, Budget and Tax audits.

– Evaluation of the internal control system.

– Implementation of controls to various operational or financial administrative fields.

CORPORATE

– Advising on dissolution and liquidation of companies.

– Advising in the transformation process.

TAX

– Assistance to respond administrative injunctions.

– Preparation and filing: o D101 Income tax return. o D103 Payroll withholding taxes. o D104 VAT declaration. o D179 Luxury tax declaration. o Others.

Contact Information

Céd. Jurd. 3-102-190856

Address: 100 mts South y 25 mts West of Hotel Thunderbird, San Isidro de El General, Pérez Zeledón, San José, Costa Rica

Telephone number: +506 771 6789 (Central Phone)

Fax: +506 771 7191 Postal Code: 845-8000, San Isidro PZ, Costa Rica. Centro América.

Web site: www.escrowtrustsolutions.com

Email addresses: info@escrowtrustsolutions.com / info@afcp.fi.cr

Costa Rica

Driver’s License

How do I renew my Costa Rican driver’s license?

1. All driver’s licenses have an expiration date; however, it can be renewed up to 3 months before the expiration date.

2. To make an appointment for renewal, call Banco de Costa Rica (BCR) at 800- BCR-CITA (800-2272482), to request an appointment (ask if there are any cancelled appointments so you may go as soon as possible). You can request to do the renewal in the branch closest to you. However, if it is urgent to renew, then pick the branch that can take you the soonest. Write down the time and place of appointment. Do not arrive late.

If you do not want an appointment, you can go directly to Cosevi, however, they do not have a bank so you must have your receipt of payment “entero” duly paid.

Requirements to renew your Costa Rican driver’s license

1. Any pending tickets must be paid; they can be paid at the time of renewal at the Banco de Costa Rica (BCR).

2. Medical exam (₡20,000 colones)

3. License this to a maximum term of 3 months of expiring or that has already expired.

4. Identification in good condition (ID or residency card)

5. Photocopy of the that identification.

6. Payment of the receipt “entero” should be made on the same day of renewal at the bank.

7. $7.00 that the BCR charges as banking commission.

Article written by: Licda. MSc. Gabriela María Elizondo Alpízar

Uvita Law Firm. April, 2017.

Will &

Testament

Creating a will in Costa Rica is a very formal process. To do this you need the following:

We need from them:

– Personal information.

– Copy of their current passport or Costa Rican ID which cannot be expired.

– Being here to be able to sign at the same time as you.

Heirs

Their personal information (Marital status, physical address not PO box and occupation).

Copy of their ID (Driver’s license from their home and/or passport)

Their email address or other way to contact them in case of emergencies.

Assets

How do you want your estate to be divided and the inheritance distributed?

Usually if it is a couple, they are mutually beneficial heirs, but if something happens to one of them everything goes to the family or someone else.

When joined families with kids from past marriages, sometimes each spouse if passing with the spouse at the same time, may assign their 50% to their own children and vice versa.

To have two translators (usually Uvita Law Firm provides you with this), but you can assign someone else. If so, we would need all the same information as the Witnesses as mentioned above and they have to be present at signing.

Probate

Process

2 Types Of PROBATE PROCESSes

There are two types of probate processes:

1- Notarial Probate: This is a more expeditious process; it takes around 3 to 6 months. A series of requirements must be fulfilled to opt for this type, among the most important are that there are no legally incapable persons, minor children and no type of litigation. This process can be started and completed with or without a will. It is important when the deceased are foreigners with assets in Costa Rica, that the documents duly apostilled and their respective official translation are obtained by the heirs or by the lawyer and Notary Public processing the probate.

2- Probate in the judicial process: This way, the process can take up to two years. It is done in court and applies if there is litigation regarding the assets or process, of minors are involved (heirs) or people that are deemed legally incapable.

At Uvita Law Firm, for the moment, we only handle notarial probate processes.

Costa Rican

Corporations

SHAREHOLDERS' REGISTRY: What is it and how can I do it?

Remember that this process requires that all corporations annually (active and inactive) must be registered in the National Registry of Transparency and Final Beneficiaries, providing the names of the owners of the corporations and the percentage of shares they hold.

When is this annual filing due?

What happens if you do not comply with the Shareholder’s Registry Filings?

What other filings are there besides the annual Shareholder Registry for my corporation?

D101 form

As of 2021, every inactive company must present a D101 Income tax form with Costa Rican Tax department.

The issue is that preparing this declaration requires accountant services: company’s accounting books must be updated, an assets valuation may be required, etc.

Since it requires an accounting specialist involved, Uvita Law Firm recommends contacting your Costa Rican accountant. If you don’t have one we recommend to use the E&T Escrow and Trust SRL’s Accounting division, to assist with the filing. They will coordinate with Uvita Law Firm to obtain the legal paperwork and do the filing form. They will send it to you for review and once approved, they will file it.

In order to do the D101 presentation, the following must be completed:

a.-) Shareholder’s Report (also known as Transparency report or Ultimate Beneficial Ownership Report (UBO).

b.-) Update form D140, a declaration to update information and change status of the corporation.

c.-) If “b” was not completed on time, you must grant or come to sign a special power of attorney to complete it. If your ID has expired and you have a new one, it must be updated. Uvita Law Firm can update your ID for you upon request.

d.-) Later the Accounting department (E & T Escrow and Trust Solutions SRL or your chosen accountant) will prepare the Balance sheet and once it is ready you will sign it and send it back to the accounting firm. Once received, they will file the D101 form.

e.-) Uvita Law Firm must prepare an Entry in the corporate books to approve the Balance Sheet for the Period.

When does the corporate tax have to be paid?

In order to comply with the above-mentioned processes, it is necessary to be up to date with your corporate taxes. These are due by the end of January of each year. You cannot pay them to the government in advance, but you can leave the money in your escrow account, if you have one and ask them to be paid the first week of January OR if you have online banking with a Costa Rican bank account, you can pay the tax online. OR you can go directly to the bank and pay in cash or from your account, just having the Cedula Juridica number (The corporate ID number). Please let Uvita Law Firm know if you need this information (your corporate ID number) or assistance on how to pay. If paid late, there is interest, but it is low. However, you will not be able to move any assets or do anything with the corporation until it is paid. If the corporation doesn’t pay taxes for THREE years, the government will dissolve the corporation and you have to reinstate the corporation and pay the interest, tax and remove the legal lien they place on the assets of the corporation until resolved.

Updated ID/PASSPORT: it is important to have an updated ID for all the previous processes (passport, residence card or other). If your ID has been renewed or changed please let us know. Uvita Law Firm can assist once you’ve obtained residency for example, to include your residency ID number on your documents, versus your passport. Or if your passport has been renewed and the number has changed, then we can do this change in the registry. This can be done remotely, so please contact Uvita Law Firm if you need your ID information renewed or changed.

Your

NEXT STEPS

1.

2.

3.

1.

Schedule A Consultation

We don’t believe in cookie-cutter solutions. Your Costa Rica law needs are unique — the support you receive should be, too. That’s why our client-focused approach begins with a consultation meeting.

We’ll ask the right questions so that we can provide you with the personal, custom support you deserve.

2.

We Get To Work

Now it’s time to get to work — aka, deliver results. We don’t believe in fluff or flattery, which is why we only promise what we know we can achieve.

Expect clear and honest communication, faster turnaround times, and creative solutions to your most pressing needs.

3.

You Enjoy Pura Vida!

You didn’t move to Costa Rica to stress about your legal interests.

With Uvita Law Firm, you get the confidence and assurance that all your legal needs are met affordably, efficiently, and honestly.

Contact Us

reception @ UvitaLawFirm.com

Phone: (506) 2743-8416

Phone: (506) 2743-8619

Fax: (506) 2743-8417

WhatsApp: (506) 8434 7459

Location

Uvita Law Firm

The Dome Commercial Center, across from the Bridgestone building,

First floor, Office #7

Uvita, Osa, Puntarenas, Costa Rica